On Wednesday, August 21, 2024, the Indian stock market continued its upward trend, with the Nifty 50 index closing in the green for the fifth consecutive session.

This positive performance was driven by gains in key FMCG and IT stocks, including ITC, Hindustan Unilever, and Tata Consultancy Services (TCS). Over the past five sessions, the Nifty 50 has surged approximately 2.6%, reflecting strong investor confidence and robust market activity.

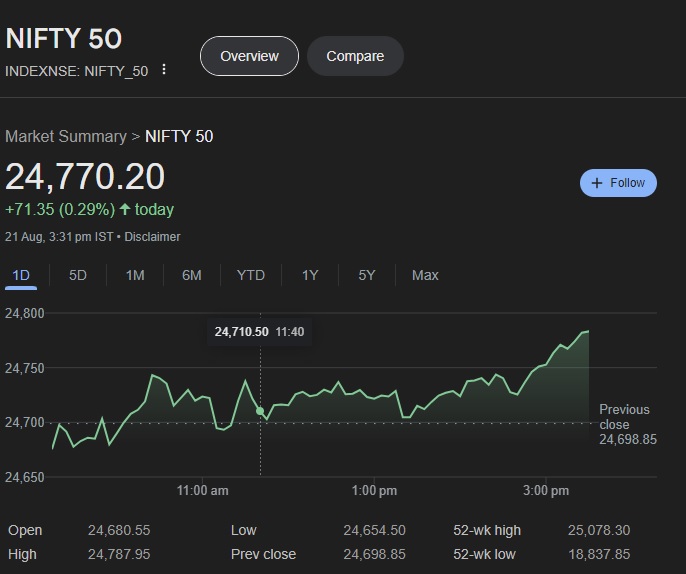

On August 21, the Sensex gained 102.44 points, closing at 80,905.30, while the Nifty climbed 71.37 points to settle at 24,770.20.

Top Nifty Gainers: Divi’s Labs, Titan Company, SBI Life Insurance, Cipla, and Grasim Industries led the market’s upward momentum.

Top Nifty Losers: On the downside, Tech Mahindra, UltraTech Cement, Tata Steel, Power Grid Corp, and HDFC Bank experienced notable declines.

Sector Performance: The Realty index saw a 1.3% decline, while the Bank index slipped by 0.2%. On the other hand, the FMCG, Pharma, Metal, Telecom, and Media sectors each recorded gains between 0.5% and 1%, highlighting a mixed sectoral performance.

The BSE Midcap index outperformed by rising 0.4%, and the Smallcap index surged nearly 1%, showcasing strong interest in mid and small-cap stocks.

Thursday NIFTY Prediction: The Nifty could see an upward trend if it crosses the 24,830 level, while a downward move might occur after breaking below 24,900. However, global market cues will play a crucial role in determining the direction. The Nifty started flat and remained steady, forming a positive candle and surpassing the previous gap from August 5 at around 24,700. Key resistance is expected between 24,830 and 24,900, with support levels around 24,550 to 24,500.

- Highest Call Writing: 24,830 (69.6 Lakhs)

- Highest Put Writing: 24,550 (80.3 Lakhs)

- Support Levels: 24,550 and 24,500

- Resistance Levels: 24,830 and 24,900

Bank NIFTY Daily Chart Prediction: For Thursday, Bank NIFTY has the potential to rally if it surpasses the 51,000 level, while a drop might be seen below 50,300, influenced by global factors. During the previous session, Bank Nifty fell to a crucial support zone of 50,350 to 50,300 but witnessed buying interest. If this support zone holds, a rally is expected. Resistance lies between 51,000 and 51,500, with support between 50,300 and 49,600.

- Highest Call Writing: 51,000 (49.3 Lakhs)

- Highest Put Writing: 50,300 (67.4 Lakhs)

- Support Levels: 50,300 and 49,600

- Resistance Levels: 51,000 and 51,500